Powering smarter lending for every

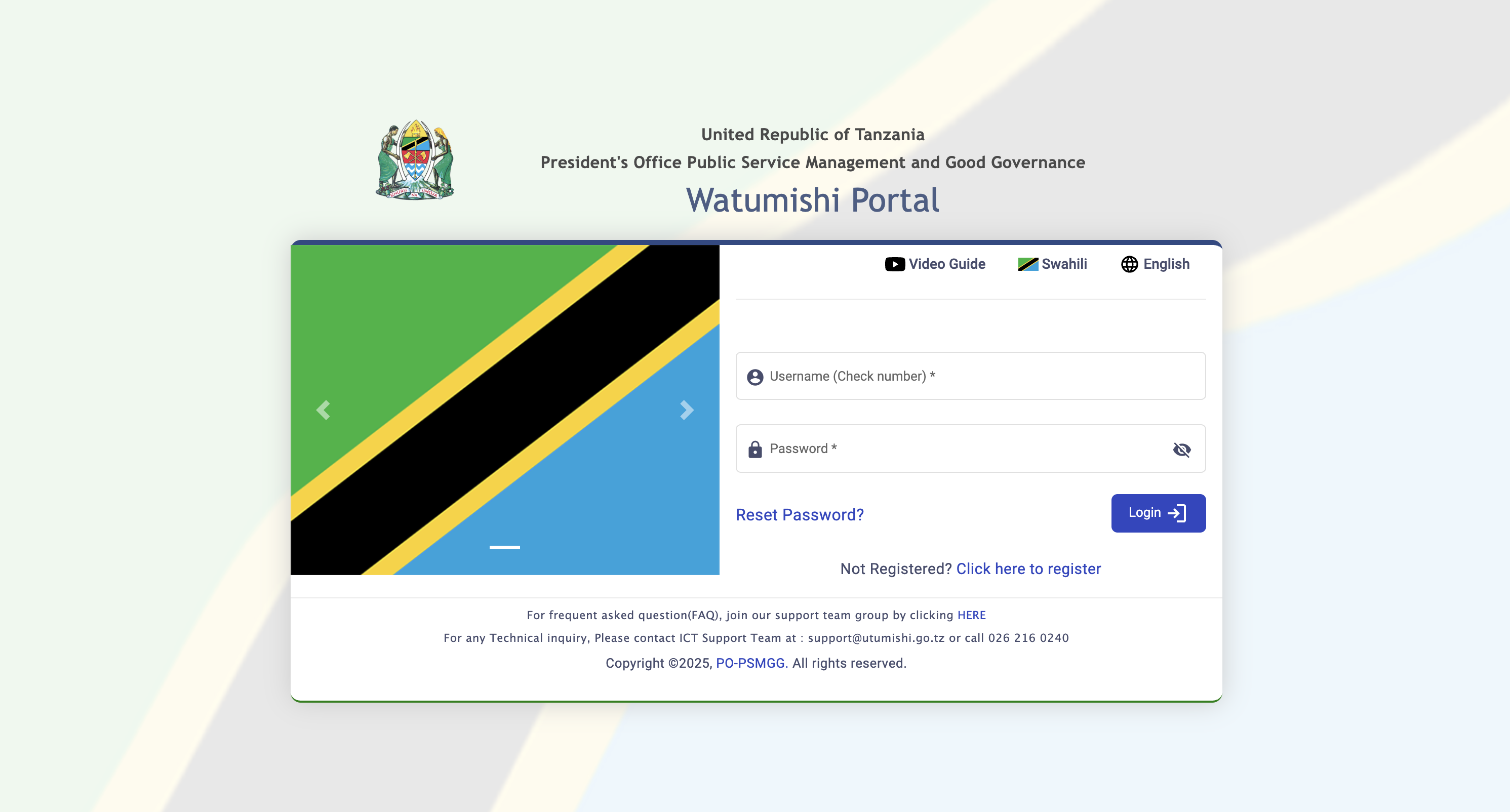

eLoan connects your MFI to ESS for secure, paperless application handling.

24 hours

Response time

98%

Satisfaction rate

Register your institution

Join other leading banks and MFIs already disbursing through the government ESS platform.

clients from banks to microfinance companies

years of experience in this business already

processed loan applications

Connect. Approve. Grow.

Tools, integrations, and insights to help your institution scale lending securely and efficiently through ESS..

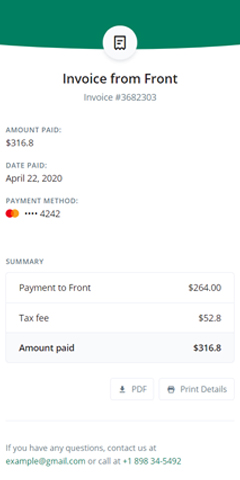

Less paperwork, more lending power

Cut down on manual processes, accelerate approvals, and scale your loan portfolio across verified public servants

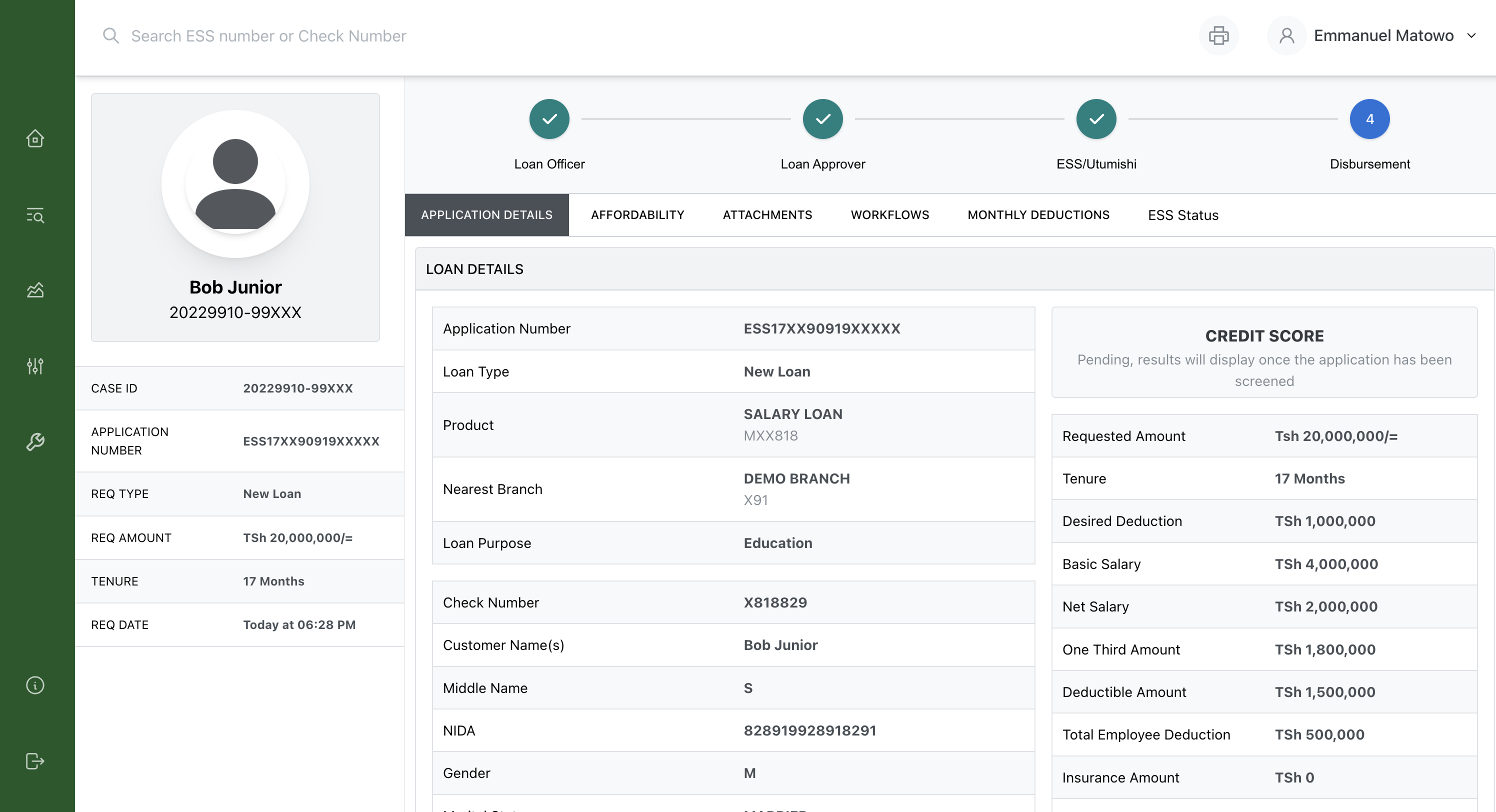

- Affordability Calculator

- New Loan Applications

- Top-Up Loan Processing

- Take Over Loans

- Loan Restructuring

- Loan Liquidation

- Stop Deductions

- Monthly Deductions

- and more...

Loan Workflow Builder

Design flexible workflows for new loans, top-ups, and takeovers no coding needed.

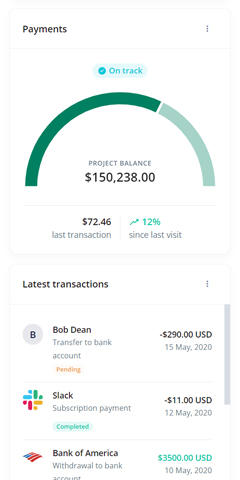

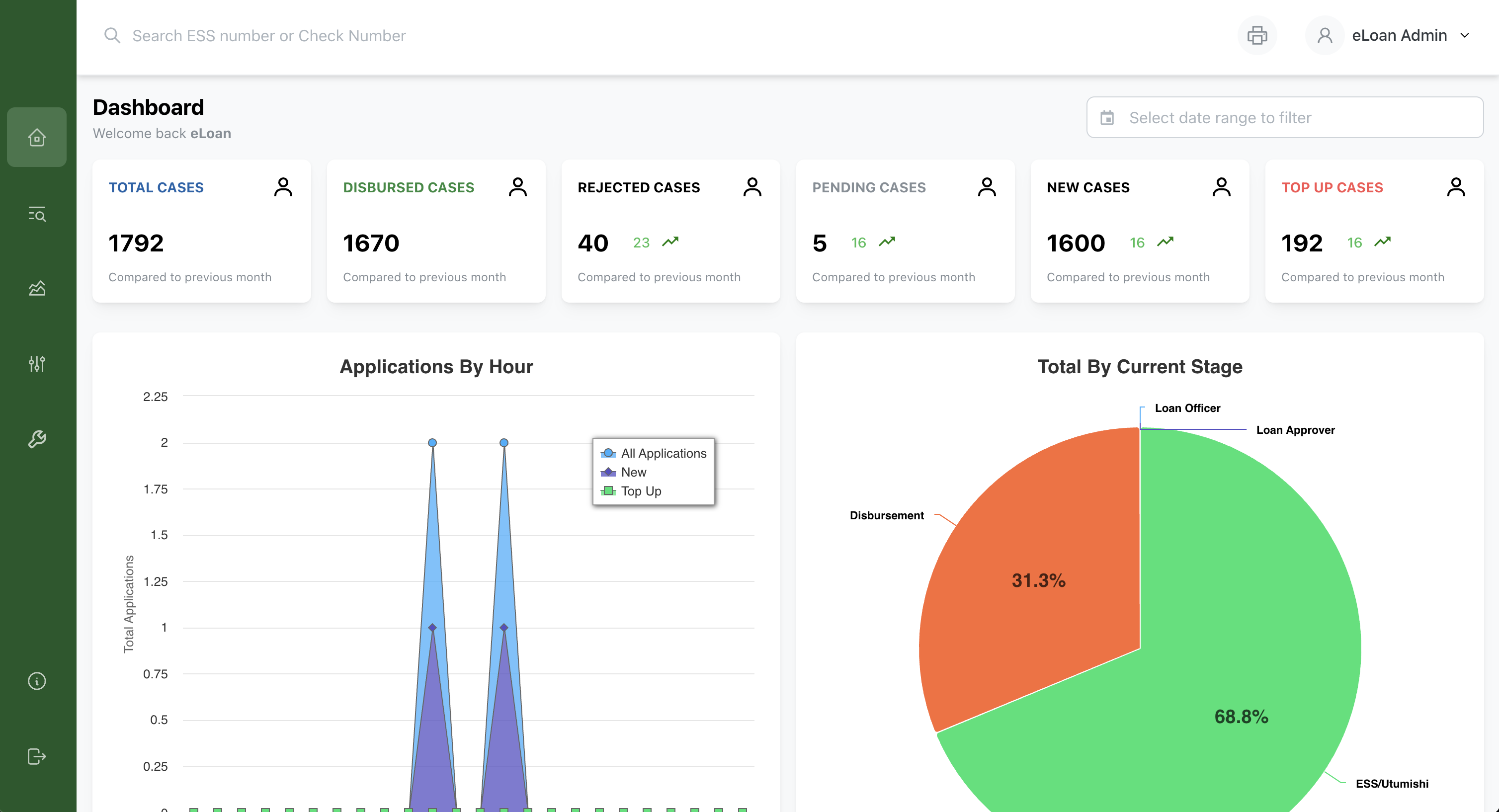

Real-Time Reporting

Track disbursements, approvals, and repayments with dynamic performance dashboards.

Smart Lending Insights

Get analytics on borrower behavior, risk exposure, and portfolio performance.

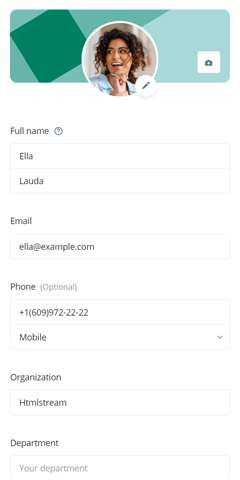

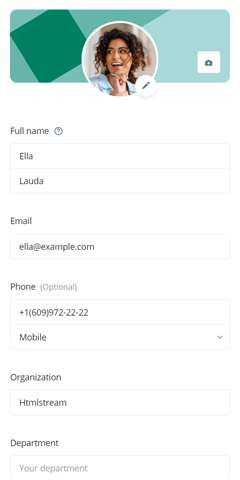

Enterprise Authentication

One click access for your institution’s staff no extra credentials needed..

Plug & Play Integration

Connect your systems easily via our secure and well documented API stack..

Payroll Sync Engine

Automatically confirm deductions against government payroll records

How it works

Joining the ESS platform is simple. We’ll support you every step of the way.

Trusted by leading financial institutions

Frequently Asked Questions

- Instant borrower verification

- Reduced default risk

- Faster loan processing

- Guaranteed salary deductions

- Scalable access to public sector employees

Visit us:

Mawenzi, Tabata, Dar es Salaam

Email us:

contact@logix.co.tz